The latest on the late incorporation of new rules for sustainability reporting (CSRD) in Sweden

Through the Corporate Sustainability Reporting Directive (CSRD), EU Member States shall ensure that large public interest entities with more than 500 employees adhere to certain reporting standards as from 1 January 2024. Other entities will also be required to report on sustainability, but these requirements will kick in between 2025 and 2028 depending on the size of the company.

The CSRD was adopted in 2022 but transposing it into Swedish legislation has proven a difficult task. After several delays in the legislative process, the CSRD has now finally been transposed with new rules entering into force on 1 July 2024. However, these new rules are not fully aligned with the CSRD as they will only apply to financial years starting on or after 30 June 2024.

The new regulations: An overview

In short, the new rules now in force mean that higher and more extensive demands are placed on companies’ sustainability reporting, both as regards structure and content. In addition, companies that were not previously required to report on sustainability will now be required to do so. There are also requirements to include the value chain in the reporting which means that others than those directly targeted by the new rules will be affected by the new reporting requirements. This can result in potential consequences for subcontractors and other counterparts of reporting companies.

Under the new rules, the sustainability report must be presented as a separate section in the management report included in the annual report and must be audited. Since the sustainability reports are a coherent part of the companies’ management report and to form part of the annual report, the CSRD has mainly been transposed into Swedish legislation through amendments and supplements to the Annual Accounts Act (Sw. årsedovisningslagen) and corresponding laws for credit institutes and securities companies. In addition, amendments have been made to the Companies Act (Sw. aktiebolagslagen) and legislation concerning auditors and auditing.

The new rules improve the comparability, consistency and transparency of companies’ ESG data. This will enable corporate stakeholders to make informed investment decisions, allowing capital to be more easily directed towards sustainable investments, thereby creating better conditions for companies with sustainable business models. The scope for greenwashing is also reduced.

Content of the sustainability report

The new rules in Chapter 6 of the Annual Accounts Act set the framework for the content of the sustainability reports, referring to the European Sustainability Reporting Standards (ESRS). The ESRS were adopted by the European Commission in 2023 to clarify which sustainability information that will have to be reported under the CSRD and ensure the quality of such information by requiring it to be understandable, relevant, verifiable, comparable, and fairly presented. Furthermore, the ESRS specify the information that companies should disclose regarding their risks, opportunities and impacts in relation to corporate governance, environmental and social sustainability issues. There are currently twelve standards:

- two general standards (general requirements and disclosures);

- five standards within environmental sustainability (climate change, pollution, water and marine resources, biodiversity and ecosystems, resource use and circular economy);

- four standards within social sustainability (own workforce, workers in the value chain, affected communities, and consumer and end-users); and

- one standard on business conduct.

Under the new rules, targeted companies must report on how sustainability issues may affect their financial position, but also on how activities linked to their operations affect people and the environment. This is also known as a dual materiality analysis (Sw. dubbel väsentlighetsanalys), the requirements of which are set out in the ESRS. It is important to note that the information requirements cover both direct and indirect business relationships in the value chain – requiring targeted companies to carry out both upstream and downstream analyses.

In addition to the ESRS, Chapter 6 of the Annual Accounts Act refers to Article 8 of the Taxonomy Regulation (Sw. Taxonomiförordningen) which also contains information that companies will have to include in their sustainability report.

The timetable: Which companies are affected and when?

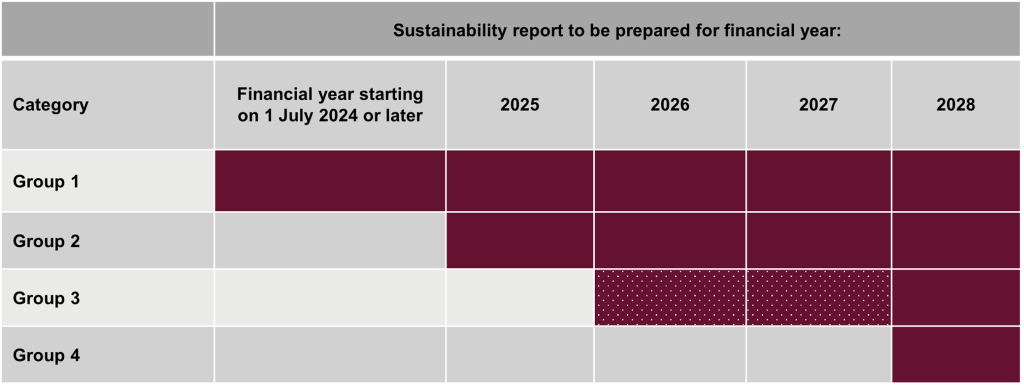

The legislative changes entered into force on 1 July 2024. Companies will have to gradually apply the new sustainability reporting requirements. Depending on the size of the company, the legislative changes and their application follow different timelines.

Group 1. Financial years starting on or after 1 July 2024

Large public interest entities (EU PIE) with more than 500 employees.

Group 2. Financial years starting on or after 1 January 2025

Other large companies/groups. This refers to companies/groups that during each of the last two financial years met at least two of the following conditions: (i) the average number of employees exceeds 250; (ii) the balance sheet total exceeds SEK 280 million; or (ii) the net sales exceed SEK 550 million.

Group 3. Financial years starting on or after 1 January 2026

Small and medium-sized enterprises on regulated markets (SMEs) and small and non-complex institutions and captives (as defined in Article 5 of the CSRD). The reporting obligation applies to SMEs that during each of the last two financial years met at least two of the following conditions: (i) the average number of employees exceeds 10; (ii) the balance sheet total exceeds SEK 5 million; or (iii) the net sales exceed SEK 10 million. Companies in this group have the possibility to postpone sustainability reporting according to CSRD for financial years starting before the end of 2027 provided that they include a statement in the management report why a sustainability report has not been prepared.

Group 4. Financial years starting on or after 1 January 2028

Subsidiaries or branches of a certain size with parent companies outside the EES and which have a turnover exceeding SEK 1.7 billion within the EES during each of the last two years and that met at least one of the following conditions: (i) a subsidiary is subject to the reporting requirements for the financial years 2025-2026 (see above); or (ii) a branch generating a turnover exceeding SEK 450 million during the previous financial year.

Consequences of non-compliance

Companies that do not actively work to comply with these new regulations and responsibilities regarding sustainability reporting risk facing severe consequences. Non-compliance can result in individual board members’ liability for damages, and in the worst case, it can lead to criminal liability in the form of fines or imprisonment as an inadequate sustainability report is considered an accounting offense.

The next step

For those companies affected by the CSRD reporting requirements, it is important to start analyzing the extent to which they currently meet the legal requirements and establish an action plan for further development of their CSRD efforts. These companies should assess how their operations are affected by sustainability issues, develop strategies and gather knowledge to comply with the requirements. They should also secure resources and expertise, conduct a risk assessment of sustainability issues and evaluate methods for performance monitoring and reporting.

It is important for those companies that are not directly affected by the new reporting requirements as of now, but will be affected in the coming years, to start preparatory work by mapping the company’s operations to understand the risks and opportunities deriving from the CSRD reporting requirements.

Relaterat innehåll